- 16 Apr , 2025

- Blog

Beginner's Guide to Digital Gold Investment

People have been trusting and investing in gold since the 4th–6th century CE.

It’s something passed down, saved, and gifted as a symbol of wealth, emotion, and safety.

So, when someone hears the term “Digital Gold,” the first reaction is often doubt. Sounds a bit odd, right?

Because gold, to many of us, is something we can touch, see, and store in lockers.

But take a second and think. Your money is digital now. You pay with UPI. You don’t always carry cash. Your bank is on your phone.

So, Why Not Your Gold, Too? Everything is going digital these days.

Digital gold works in the same way. You can buy digital gold online, store it, and track it right from your phone. No need for physical lockers or fear of theft.

Just a few taps on your phone, and it’s all yours.

In this blog, let’s break down how digital gold investment works, why it’s gaining popularity, and how to invest in digital gold smartly, step by step.

What Is Digital Gold?

Digital gold is an easy and modern way to invest in gold without the stress of storage and safety concerns that come with physical gold. It allows you to buy gold online in small fractions, starting from just Rs. 1, with assured 24 K gold of 99.99% purity.

This means you can start saving or investing in gold anytime, from anywhere, using just your phone. Every unit you buy is backed by real physical gold stored safely in secure vaults.

Whether you’re saving small amounts or building long-term wealth, digital gold offers a safe and convenient way to do it.

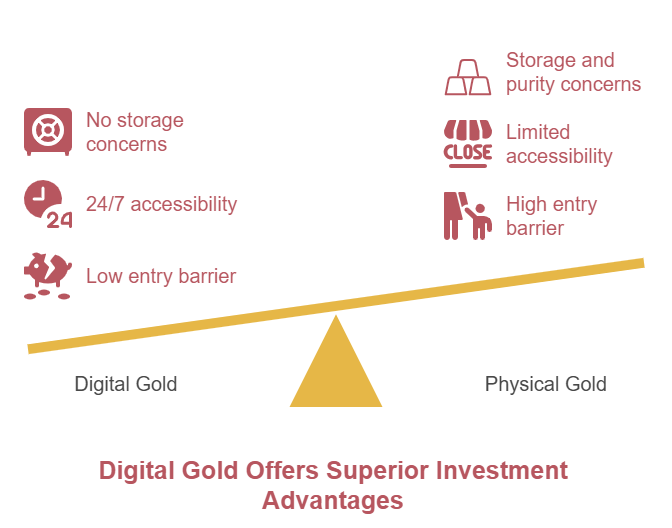

Why Choose Digital Gold Over Physical Gold?

Digital gold has entered the gold market to solve many of the problems that physical gold brings. The features of digital gold over traditional physical gold make it a more appealing investment option.

-

Low Entry Barrier:

Digital gold allows you to start investing with as little as ₹1. This makes it much more accessible to people who may not have a large amount to invest initially. Whether you're just starting your investment journey or adding gold to your existing investment portfolio, digital gold gives you the flexibility to invest in small amounts.

-

24/7 Accessibility:

You can buy or sell digital gold anytime, anywhere, from your phone or computer. The ease of access means you're not limited by store hours or availability. No matter the day or night, you have the power to manage your investment at your convenience.

-

No Physical Storage and Purity Concerns:

Unlike physical gold, digital gold eliminates the need to worry about storing your gold securely or verifying its purity. Every unit of digital gold is backed by 99.99% pure gold stored securely in regulated vaults.

-

Liquidity – Buy/Sell Anytime:

Digital gold offers high liquidity. You can sell or buy more whenever you need to without worrying about finding a gold buyer or seller. It’s a flexible investment that moves as fast as you need.

-

Safe And Regulated:

Digital gold is a safe and regulated investment. It is managed by trusted providers and ensures the gold is stored securely, giving you peace of mind in knowing your investment is protected.

Key Benefits of Investing in Digital Gold

Not everyone has the time to visit a jewellery shop or think about lockers and security. Life is busy. But savings matter. So, digital gold is making things easy for you.

Still wondering why people are shifting towards digital gold? Let's take a look at the benefits of digital gold.

1. Convenience Of Online Buying

You don’t need to visit a store. No waiting in lines and worrying about carrying cash. You can buy gold anytime, from anywhere. Whether you’re at home, in the office, or even while having chai on your balcony, it’s that easy. Just open the DigiGold app, check the live price, and make your move. It’s quick, smooth, and fits into your day like anything else online.

2. Transparent Pricing Based On Real-Time Gold Rates

The best part about digital gold platforms. You see the real-time gold prices that are running in the gold market. There are no hidden charges or shady pricing. Digital gold platforms show you live prices. So, whatever you buy, even if it’s worth just ₹100, you know exactly how much gold you’re getting. Pure value. Pure trust.

3. 100% Gold Purity Backed By Real Gold

Every rupee you invest goes into 24K gold with 99.99% purity. And it’s backed by real physical gold stored safely in secure vaults. You’re not just buying numbers on a screen. You’re actually owning real gold, just without the holding weight and worry.

4. Secure Storage Without Extra Cost

Storage is a big headache with physical gold. Not anymore. You don’t need to rent a safety deposit box or find storage space at home. Digital gold is stored securely in vaults, and the best part? You don’t pay extra for that security. Your gold is stored in highly secured vaults managed by trusted partners. And yes, you can track your balance anytime.

5. Option To Convert Into Physical Gold (Coins/Bars)

Want to turn your digital gold into real coins or bars? You can convert your digital gold into physical gold. Whenever you feel like gifting gold or keeping something in hand, just request delivery. Many digital gold platforms like DigiGold offer doorstep delivery of your digital gold. So, your investment is always flexible.

6. Ideal For Saving Goals, Gifting, Or Monthly Investments

Planning for something big? Maybe a wedding, a future trip, or just a better habit of saving? Digital gold is perfect. You can invest in small amounts with ₹1 every week or month or set up a monthly digital gold SIP, starting from 500. It’s also a beautiful, thoughtful, valuable, and timeless gift option for birthdays, festivals, or baby showers. You’re not just giving gold. You’re giving growth and security.

There are no major cons of digital gold for beginners. The only thing you need to focus on is choosing a trustworthy digital gold platform.

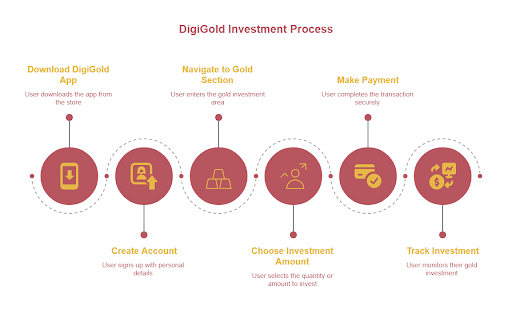

How Digital Gold Works?

Just like you order groceries or pay bills online, buying digital gold is just like that. And with the DigiGold app, the whole buying process is simple, fast, and safe.

Here is the Step-by-Step Process to Buy Digital Gold from the DigiGold App

Step 1: Download the DigiGold App

Go to the App Store or Google Play Store and download the DigiGold app on your phone.

Step 2: Create Your Account

Open the app and sign up with your basic details like name, age, and mobile number.

Step 3: Go to the “Gold” Section

Once you log in, tap on the “Gold” section to start your digital gold investment.

Step 4: Choose the Amount or Grams

Now, decide how much silver you want to buy. You can either choose how many grams you want to buy or enter the amount you wish to invest.

Step 5: Make Your Payment

Pay using UPI, bank transfer, or your debit/credit card. It’s smooth and secure.

Step 6: Track Your Silver Investment

Right after the purchase, your gold will show up in the app. You can track it anytime from anywhere in your DigiGold wallet.

Note: KYC is not required unless your total transaction crosses ₹1,80,000. So, for small and regular investments, it’s a smooth experience.

Want to build a regular habit of saving? Check out our guide to investing in Digital Gold SIP. It’s a simple way to grow your wealth every month.

Taxation on Digital Gold Investment

If you sell your digital gold within 3 years, the profit is called a short-term capital gain (STCG). It will be taxed based on your income slab, just like your regular income.

But if you hold the digital gold for more than three years, it becomes a long-term capital gain (LTCG). In that case, the tax is 20% with indexation benefits.

Smart Tips for Digital Gold Investment Beginners

1. Start Small But Stay Consistent

Begin with a small amount, but build the habit and stay regular with your investments.

2. Invest Regularly Via SIP Options

Set up a monthly auto SIP to grow your savings without pressure. It keeps things simple and steady.

3. Don’t Fall For Fraud Platforms—Always Verify The Source

Use trusted apps and check if the platform is verified. Never share your details with unknown sources.

4. Track Gold Rates And Stay Updated

Keep an eye on market prices. Knowing the trends helps you make better buying decisions.

Make the Golden Move Digitally Today

Digital gold is the future. You can start small, stay flexible, and grow your savings with peace of mind.

And if you're thinking of starting, start with a platform that’s built on trust, experience, and simplicity. DigiGold brings you the future of gold investment right at your fingertips.

Start your digital gold journey with a name trusted across India.

Here’s Why Digigold Is The Right Choice For You:

- Pure 24K Gold (99.9%)

Your gold is backed by real, pure gold stored safely in BRINKS vaults—trusted by the government. - Backed by 40+ Years of Expertise

Powered by Amrapali Gujarat, a trusted name in the bullion industry for over four decades. We're among India’s top 5 gold and silver bullion dealers. - Top-Notch Security Standards

The DigiGold app follows all government-approved cybersecurity guidelines for safe transactions. - No-Lock SIP Plans

Start your SIP with just ₹500. No lock-ins. No stress. Fully flexible. - Daily Customer Support

Our support team is available 24/7 to help you. - Fully Accredited and Recognised

DigiGold is NABL and BIS accredited and proudly supported by GGC and SEQUEL.

Why wait? Download the DigiGold app and invest in digital gold today.