- 31 Aug , 2023

- Blog

Money-Saving Magic: 10 Modern Ways to Save Big!

No, don’t worry it’s not going to be the same old boring blog that you might have already read on the internet, instead we’ll be discussing some effective ways you can save your money!

Let’s start with this famous quote from Kevin O’Leary-

“Money is my military, each dollar a soldier. I never send my money into battle unprepared and undefended. I send it to conquer and take currency prisoner and bring it back to me.”

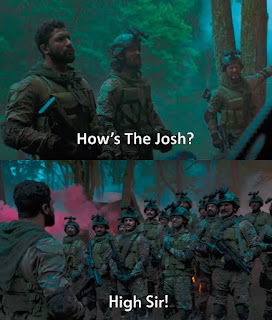

You should treat yourself as a captain standing on the border & in constant battle with the enemies (in this case, unnecessary expenses, & inflation) dictating the direction of your hari patti army (rupees)!

Imagine yourself as a wise captain, commanding a brave army of rupees on the borderlines of financial security. In this constant battle against the enemies of unnecessary expenses and inflation, each rupee becomes a loyal soldier at your command.

Just as a skilled military strategist, you never send your hard-earned money into battle unprepared and undefended. Instead, you deploy it with a purpose – to destroy hasty spending, capture sensitive savings, and ensure a victorious return.

Treat your money as a disciplined force, marching towards the ultimate goal of accumulating wealth, so that it may faithfully serve and protect your financial future.

Without any further due let us get straight to the points as promised that will deliver the

#1 Winning = Not Losing

You know, we often hear people saying that positive thinking will only bring good things into our lives. But let's face it, life isn't always that simple. It's full of surprises and unpredictability. That's why it's smart to be prepared for the unexpected, like having your own army ready to tackle whatever comes your way.

Take insurance, for example. It's like a safety net that saves you from those unforeseen crises you never saw coming. Trust me, it's one of the best ways to protect yourself against financial loss. You never know what life might throw at you, so having a solid insurance portfolio is like having a secret weapon against the unknown.

So, why not be proactive and get your financial defences in place? Having that peace of mind is worth every penny, and you'll be thanking yourself later.

#2 Kya tum bhi ho Lapata?

You know, wandering around aimlessly can really drain your energy and your wallet. It's essential to have clear spending and saving goals, but that's only possible when you have a good grasp of your income. Luckily, we live in a time where mobile money management tools, like expense tracker applications, make it super easy to stay on top of your finances.

With these nifty apps, you can seamlessly incorporate financial awareness into your daily routine. Say goodbye to the stress of not knowing where your money is going. So, don't let your money slip through your fingers.

#3 Steal the deal

Oh, you won't believe the incredible deals you can find these days! Whether it's on online shopping platforms or even those awesome seasonal offers in brick-and-mortar stores, they bring out the big guns with major price drops on their products. So, why not take advantage of these golden opportunities to get your hands on that dream item without breaking the bank?

Timing is everything, my friend. If you keep an eye on those sales and discounts, you'll be amazed at how much you can save. Imagine snagging your most desired product at a fraction of its original price – that's the kind of shopping victory we all crave!

#4 Know your capacity- Maintain budgets

Picture this: you, yes you, stepping into the world of budgeting like a financial superhero, gaining unparalleled control over your hard-earned money. Creating a budget might sound mundane, but believe me, it's the key to unlocking your financial potential like never before.

Think of it as your secret identity, the tool that empowers you to track your income and expenses with precision. With a budget in hand, you become the captain of your financial ship, steering it in the right direction.

Out of all, this is one of the most effective ways to save money, given that it is a famous middle-class strategy that is used in multinational businesses or any other households.

#5 Modern-Day Plugins to save big

Don’t you always get swayed away by always landing on these multiple online platforms to shop? Your carts keep on getting heavier, you can’t help but keep increasing your wishlists. Here is the solution to your urge to buy things.

There are some smart Chrome extensions that help you see price automatically applies coupons on the internet, compares current prices with historic price charts and comparison of price with other platforms.

#6 Second-hand is actually a smart thing

Let me tell you about the incredible treasure troves waiting to be discovered! Thrift stores, online marketplaces, and garage sales are like secret havens for hidden gems just waiting to be found. You won't believe the amazing things you can stumble upon – from fashionable clothing to top-notch electronics, all at a mere fraction of their original cost!

Seriously, it's like a never-ending adventure and the best part? Your wallet will thank you for it! With this savvy approach, you can stretch your budget like never before. It's like getting a personal discount on all your favourite items. Who doesn't love that feeling?

Robert Kiyosaki emphasizes understanding depreciation's impact on finances. While some items depreciate rapidly, certain high-quality furniture and collectables may appreciate over time but mostly making second-hand purchases wise investments.

Opting for second-hand chairs and stools is a no-brainer; they retain value and allow significant savings without compromising quality or aesthetics.

#7 The Power Of Negotiating: A traditional way to save money

We have all seen our mothers, bargaining with vendors like artists. The way they persuade to even ask for a 20 Rupees discount is a commendable scene to witness. Isn’t it?

Imagine, for a week, you spend 100 Rs every day on vegetables and fruits, and you bargain for 20 Rupees. You end up saving 140 Rs of the total expenditure of 700 Rs. You save 20% of your expected expense.

Negotiating is a valuable skill that can be honed and applied in various situations to achieve favourable outcomes and can help you embrace win-win.

#8 Let your money work for you, while you sleep!

As famously said by Greatest investor of all time, Warren Buffet -

“Make money while you sleep or Work until you die”

Segregating your income and putting it in a fixed deposit account for low amount interest is not a good idea & you already know our villain “inflation”. There are many modern ways to save where your money will grow while you sleep & at a higher rate than inflation.

Trusted online platforms like DIGIGOLD where saving money is fun in 999.0 pure Gold & Silver at flexible amount starting from just ₹1.

Fun Fact: Warren Buffett has invested almost $1 billion in silver.

(Source: investopedia.com)

#9 Don’t be instantly Decisive

In the world of shopping, discounts can often be tempting traps that lead us into making impulsive decisions. While discounts can provide excellent opportunities to save money, it's essential to exercise caution and avoid falling into the "buying frenzy" just because something is available at a lower price.

When faced with a discount, take a moment to evaluate the item's actual value. Consider whether it is something you genuinely need or if it aligns with your long-term goals. Just because an item is cheaper doesn't mean it's a good deal if it ends up collecting dust in your closet.

Protip: When a certain product is added to cart but not completed purchase, sometimes companies provide you coupons as reminder & a bait to complete your purchase. Walla! You just saved some amount on that purchase, thank us later.

#10 Micro Planning, Major Results

Microplanning holds the key to unlocking major financial results.

Create a "Rent, Borrow, or Buy" graph to visualize the costs and benefits of each option. For instance, consider renting tools for one-time use instead of buying them.

Just like you probably have your friends Netflix password or probably shared yours with a friend, Shared Buying with friends or family can save you lot of money.

Additionally meticulously managing your restaurant meals, optimising utilities, and making thoughtful decisions about renting, borrowing, and buying, you'll witness the transformation of your financial landscape.

Conclusion

Throughout this money-saving adventure, we've explored ten powerful strategies to bolster your savings and achieve financial freedom.

Unlock Your Savings Potential

Join Forces with DIGIGOLD for Smart Saving Adventures!

Embrace DIGIGOLD as your trusty sidekick in the world of precious metal investments, adding strength and stability to your portfolio.

Embrace the Thrills of Financial Freedom

Now it's time to embark on your own money-saving superhero journey. Embrace these strategies, make them your own, and unleash the full potential of your financial future.